The Government of India is all set for an increase in gratuity limit to ₹20 lakhs. Companies reporting under Ind AS 19 will be affected more than those reporting under AS 15. This post provides the background on gratuity benefit and explains the accounting implications for companies.

Update: The increase in gratuity limit has come into effect from 29 March 2018. Read this post on the latest developments.

Payment of Gratuity Act 1972

Currently, the Payment of Gratuity Act 1972 (‘PG Act’) prescribes that a lump sum gratuity be provided to any employee who resigns, dies or retires from the company after completing about five (5) years of continuous service.

Payment of gratuity rules are quite extensive, and are not discussed in this post. Full details can be obtained from Ministry of Labour website here.

Broadly, the gratuity is calculated as 15 days’ salary for each year of service; for an employee who worked for 5 years, this translates to about two and a half months of salary. However, the Act places an upper limit on the gratuity amount payable; this limit is currently set at ₹10 lakhs. It is this limit of ₹10 lakhs, that is proposed to be increased.

What we know from the recent developments

In 2010, the Sixth Pay Commission increased the maximum gratuity limit for central government employees from ₹3.5 lakhs to ₹10 lakhs. This was followed by a similar increase in gratuity limit for the private sector employees.

Therefore, in 2016 when the Seventh Pay Commission increased the maximum gratuity limit for central government employees from ₹10 lakhs to ₹20 lakhs, there was a general expectation that the recommendation of the Seventh Pay Commission will also be extended to the private sector employees.

Earlier this year, the Labour Ministry agreed to raise the gratuity limit for private sector employees to ₹20 lakhs. In September, this limit was approved by the Cabinet.

On 18th Dec 2017, the Labour minister introduced the Payment of Gratuity (Amendment) Bill, 2017 in the Parliament which will allow gratuity to be revised as per wage, inflation and future pay commissions (read more here).

What to expect next?

Once the amendments are approved by the Parliament, the increase will be notified in the Gazette of India. The effective date of the amendment will also be notified. The amendments could be made retrospectively; i.e. the limit increase could be made effective from a date prior to the date of notification.

How will companies be impacted by an increase in gratuity limit?

Companies will need to be aware of the timing of when this change will affect them, as well as the financial impact of this change.

Timing Impact

When companies will be affected by the increase, will depend on when the gratuity limit amendment is notified. There are three possibilities:

- The increase is notified prior to 31 March 2018.

In this situation, the impact of the amendment will be recognised in the financial statements for the current financial year; i.e. FY2017-18. - The increase is notified after 31 March 2018 and is effective prior to 31 March 2018.

In this situation, the financial statements for the current financial year; i.e. FY2017-18 will need to be restated to reflect the limit increase at the time of next year’s reporting; i.e. FY 2018-19. This assumes that the financial statements have been prepared before the increase in limit is notified. - The increase is made applicable from a date after 31 March 2018.

In this case, the impact will be captured in the financial statements of the coming year; i.e. FY 2018-19.

It is recommended that companies disclose an impact analysis as part of their annual returns or reports regardless of when the limit increase is notified.

Update: The increase in gratuity limit has come into effect from 29 March 2018. Read this post on the latest developments.

Financial Impact

Irrespective of when the increase in gratuity limit is notified and made effective from, all affected companies will see an increase in their gratuity liability. The increase in gratuity limit will affect the benefits that has already been accrued, right from the time an employee joined the company.

For further details about the methodology and other topics about calculation of gratuity liability, as well as liability of other employee benefits, refer to the main actuarial valuation topic page here.

This increase in liability will need to be recognised through a corresponding charge to P&L statement. The financial impact will be different for Ind AS 19 and AS 15.

Ind AS 19

Under Ind AS 19 (as well as IAS 19), whole of this increased liability will be recognised immediately in the P&L statement under the head ‘past service cost’. Therefore, companies reporting under Ind AS 19 will face the full force of this amendment immediately.

AS 15

For companies reporting under AS 15, the financial impact will be slightly less onerous. AS 15 splits this ‘past service cost’ into vested and non-vested components.

- The vested component is the past service cost in respect of those employees that have completed 5 years of service as at the effective date of amendment, and are therefore entitled to receive gratuity immediately if they left the company. Vested past service cost will need to be recognised immediately in the P&L statement.

- The non-vested component is the past service cost in respect of those employees who have less than 5 years of service. AS 15 allows companies to spread this non-vested past service cost over the average outstanding duration till vesting. Let’s say, on an average, those employees who have less than 5 years of service, have an average past service of 2 years. The non-vested past service cost can be spread over 5 – 2, i.e. 3 years.

For more information on differences between AS 15 and Ind AS 19, refer to this post.

Illustration of the quantitative impact

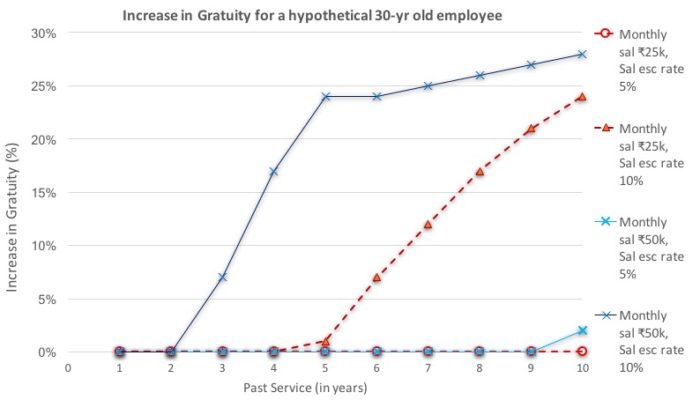

Though an increase in gratuity limit from ₹10 lakhs to ₹20 lakhs may seem a huge increase, many companies will see only a marginal increase in their gratuity liability. The maximum impact will be on companies that have high average salaries and, more importantly, use a high salary escalation rate assumption in their actuarial valuation. For companies paying lower salaries, the existing gratuity limit will not be reached anyway, so an increase in the limit have no effect.

The chart below shows the increase (as %) in total gratuity liability for different salary and past service combinations:

As can be seen from the above chart, companies with low average salaries and low salary escalation assumption may not see any significant increase in their gratuity liabilities.

The illustration above is highly simplified and is based on:

- current age of 30 years

- retirement age of 58 years

- discount rate of 7% and

- attrition rate of about 5%.

In our previous posts, we have explained how to set discount rate, salary escalation rate and attrition rate assumptions for actuarial valuations.

Download our white paper on Indian Accounting Standards for employee benefits by clicking on the picture below. Covers Ind AS 19 and Ind AS 102