Key Takeaways

- Fair value is mandatory: Ind AS 102 requires fair value measurement for employee stock options. Intrinsic value is permitted only in rare cases where fair value cannot be reliably estimated.

- Black-Scholes: Most widely used in India – simple but cannot handle complex features like performance vesting or caps/floors

- Binomial Model: More flexible for complex schemes – can incorporate vesting events and employee departure probabilities

- Monte Carlo: Most accurate method – handles any level of complexity and non-lognormal distributions, but computationally intensive

Contents

With the arrival of Ind AS, companies need to value and account for their stock option schemes using the fair value method. There are more ways in which Ind AS will affect companies running employee stock option schemes. These are described in more detail in our post on how Ind AS 102 affects your company. This post focuses on methods to carry out fair valuation of employee stock options.

1. Background

Stock option plans have been highly successful globally in aligning the interests of employees with shareholders. In India too, many companies offer stock options to remunerate their employees.

Grant of stock options to employees is a cost to the company when they are granted, or a liability that is yet to be settled from a company’s perspective. Globally, there are accounting standards that deal specifically with the accounting of employee stock options – IFRS 2 and ASC 718 (US GAAP). But the situation in India hasn’t been so clear. There hasn’t been a comprehensive accounting standard dealing with stock option accounting. There are a range of rules and guidelines that affect different companies differently. For example, listed companies are governed by SEBI (Share Based Employee Benefits and Sweat Equity) Regulations, 2021, which replaced the earlier 2014 regulations. The ICAI has published the Guidance Note on Accounting for Share-based Payments (Revised 2020), which applies to companies following Accounting Standards (non-Ind AS).

For companies falling under the purview of the Indian Accounting Standards, Ind AS 102 mandates fair value measurement for employee stock options. Intrinsic value is permitted only in rare cases where the fair value of equity instruments cannot be reliably estimated (Ind AS 102, para 24). For more on ESOP and SAR accounting under Ind AS 102, see our detailed guide.

2. Fair Value vs Intrinsic Value

A simple relationship exists which helps understand fair value concepts:

Fair value = Intrinsic value + Time value

Time value can only be non-negative. Therefore, companies using the intrinsic value method understate the value of their stock options.

The general approach is to calculate the fair value using one of the methods described below, and then time value is the difference between fair value and intrinsic value.

3. Valuation Methods

Fair value, as required under Ind AS 102, can be calculated using any of the following methods, depending on the desire for accuracy and complexity of the options:

Black-Scholes Formula

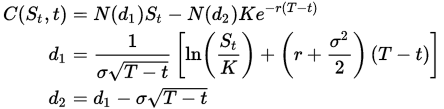

This is the most widely used method and is considered appropriate for small schemes with simple rules. The formula is:

The parameters are share price (S), exercise price (K), volatility (sigma), duration till exercise (T) and risk-free rate (r).

Advantages:

- Simple to calculate once parameters are known

- Well-understood and widely accepted

Limitations:

- Cannot accommodate complex features (e.g., variable exercise prices, caps, or floors)

- Does not account for performance-based vesting conditions

- Assumes constant volatility and risk-free rate over the option term

- Assumes lognormal share price distribution

- May be inaccurate during market stress conditions

Black-Scholes is most widely used in India for ESOP valuation. However, companies need to understand the limitations and ensure this method is appropriate given their specific circumstances – particularly if their scheme has performance conditions or other complex features.

Binomial Model

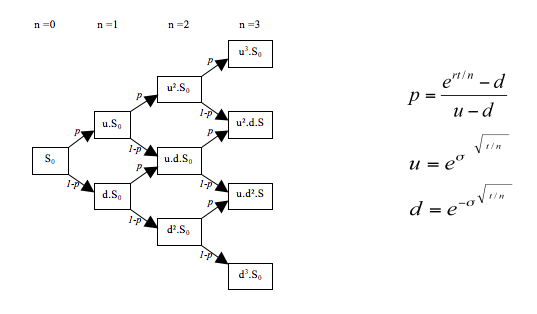

The binomial model is more advanced and involves the use of computational techniques. In this model, the share price is projected from the date of grant to the date of exercise using ‘up’ and ‘down’ probabilities:

The probabilities are estimated from the share price volatility assumption.

Advantages:

- More robust than Black-Scholes

- Can accommodate complicated rules and events during vesting period

- Can incorporate probability of employee departure

- Handles early exercise behavior

Limitations:

- Also assumes lognormal distribution

- Requires computational techniques

Despite being simple and more robust than Black-Scholes, binomial model usage is limited in India. In our view, this should be the model of choice even for simpler schemes, given its flexibility.

Monte Carlo Method

As with the binomial model, this method also involves projecting the share price. However, the projection is not restricted by pre-defined up and down probabilities. Instead, the share price is ‘sampled’ from the chosen distribution.

The method involves projecting the share price under hundreds of different scenarios, each constructing a unique ‘path’.

Advantages:

- Most accurate of all option pricing methods

- Can handle any level of complexity in scheme rules

- Deals with pre-vesting events

- Can use non-lognormal distributions for more accurate results

- Especially useful when capital markets are stressed

Limitations:

- Results take time due to computational complexity

- Can be more difficult to interpret

Monte Carlo methods are hardly ever used in Indian markets. In our view, these methods should be used more often, especially now when computational power is much less of a concern.

4. Method Comparison

| Feature | Black-Scholes | Binomial | Monte Carlo |

|---|---|---|---|

| Complexity | Low | Medium | High |

| Accuracy | Basic | Good | Highest |

| Performance vesting | No | Limited | Yes |

| Market conditions | No | Limited | Yes |

| Early exercise | No | Yes | Yes |

| Non-lognormal distributions | No | No | Yes |

| Usage in India | Very common | Limited | Rare |

5. Which Method Should You Choose?

| Your Situation | Recommended Method |

|---|---|

| Simple scheme, standard vesting, no performance conditions | Black-Scholes (but Binomial is better) |

| Graded vesting, employee departure probability matters | Binomial Model |

| Performance-based vesting (TSR, EPS targets) | Monte Carlo |

| Market conditions affect vesting | Monte Carlo |

| Caps, floors, or reload features | Monte Carlo |

Need ESOP Valuation for Ind AS 102 Compliance?

We provide employee benefits valuation services including ESOP and SAR valuations using Black-Scholes, Binomial, and Monte Carlo methods.

May 24, 2018 at 10:39 pm, 4 ways in which Ind AS 102 can affect your company • Numerica said:

[…] These methods are described in more detail in this post. […]

September 27, 2019 at 11:41 am, ESOP and SAR: Ind AS 102 perspective • Numerica said:

[…] Having said the above, Black Scholes formula is the most popular method for option valuations. The other methods such as a Binomial model or Monte Carlo method are not as popular because of the complexity and the cost-benefit factor. To know more details about these 3 methods, please click here. […]