Key Takeaways

- Day-one provisioning: IFRS 9 requires recognising ECL on trade receivables immediately – not waiting for invoices to become overdue

- Provision matrix: Group receivables by risk characteristics, calculate historical loss rates by ageing bucket, adjust for forward-looking information, then apply to current balances

- Default definition: You must document what constitutes “default” (e.g., 90 days past due) and align this with your internal credit policy

- Forward-looking adjustment: Historical loss rates alone are not sufficient – you must incorporate current conditions and macroeconomic forecasts

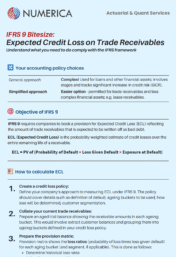

IFRS 9 replaced the old “incurred loss” model under IAS 39 with an “expected credit loss” model. Instead of waiting for evidence that a customer won’t pay, you now provision for ECL on trade receivables from day one based on what you expect to lose. For trade receivables without a significant financing component (i.e., payment terms under 12 months), you can use the simplified approach – recognising lifetime ECL without tracking credit risk stages.

The most common method for calculating ECL on trade receivables under the simplified approach is a provision matrix. This is a table that shows your receivables by ageing bucket, applies a loss rate to each bucket, and calculates the resulting ECL.

How to Calculate ECL on Trade Receivables: 5-Step Provision Matrix

Step 1: Group Receivables by Shared Credit Risk Characteristics

Not all customers carry the same risk. Before calculating loss rates, segment your receivables into groups with similar characteristics:

- Geography – Customers in different regions may have different payment behaviours

- Customer type – Government vs. private sector, large corporates vs. SMEs

- Product line – Different products may attract different customer risk profiles

For GCC entities, government and quasi-government receivables typically warrant a separate group given their different (usually lower) risk profile.

Step 2: Define Your Default Threshold

Before you can calculate loss rates, you need a clear definition of what constitutes default. This should align with your internal credit policy and be applied consistently.

Choosing Your Default Threshold

Your default threshold should be a days-past-due cutoff aligned with your credit policy – this could be 30, 60, 90, 120, or even 180 days depending on your industry and customer payment norms. Construction and government-facing businesses often use longer thresholds; fast-moving consumer businesses use shorter ones. IFRS 9 includes a rebuttable presumption that default occurs no later than 90 days past due, but this is a backstop, not a mandate. The key requirement: whatever threshold you choose must be observable in your aged receivables data so you can apply it consistently when calculating historical loss rates.

Document your chosen definition in your ECL policy. Auditors will expect consistency between your default definition and your historical loss rate calculations.

Step 3: Calculate Historical Loss Rates by Ageing Bucket

This is the core of the provision matrix. You need to analyse how receivables have historically migrated through your ageing buckets and ultimately ended up in default.

The process:

- Select a historical period – Typically 2-5 years, long enough to capture a range of economic conditions

- Track migration patterns – For receivables originated in that period, track how they aged: what percentage was collected while current, what percentage moved to 30 days overdue, then 60 days, and so on

- Identify defaults – Of receivables that reached each ageing bucket, what proportion ultimately defaulted (per your definition)?

- Calculate loss rates – For each bucket, divide total losses by the amount that reached that bucket

The key insight: loss rates should increase as receivables age. A current receivable has a lower probability of default than one already 90 days overdue.

| Ageing Bucket | Receivables Reaching Bucket | Ultimate Losses | Historical Loss Rate |

|---|---|---|---|

| Current (not yet due) | 10,000,000 | 50,000 | 0.5% |

| 1-30 days past due | 5,000,000 | 50,000 | 1.0% |

| 31-60 days past due | 2,000,000 | 50,000 | 2.5% |

| 61-90 days past due | 500,000 | 50,000 | 10.0% |

| Over 90 days (default) | 100,000 | 50,000 | 50.0% |

Example: If 50,000 in losses ultimately arose from receivables that passed through the “current” bucket, and 10,000,000 in receivables passed through that bucket, the historical loss rate is 0.5%.

Step 4: Adjust for Forward-Looking Information

Historical loss rates reflect past conditions. IFRS 9 requires adjustment for current conditions and reasonable forecasts of future economic conditions.

Ask: are conditions during the forecast period likely to be better or worse than the historical period?

Factors to consider for GCC entities:

- Oil prices – Affects government revenues and broader economic activity (see our latest discount rate assumptions for Saudi Arabia for current market conditions)

- Real estate market – Particularly relevant for construction and property sectors

- Industry outlook – Sector-specific trends affecting your customer base

A simple approach is to apply a percentage adjustment to historical rates. For example, if you expect economic conditions to deteriorate, increase rates by 10-20%. Document your rationale.

Step 5: Apply Rates and Calculate ECL

Apply the adjusted loss rates to your current receivables balance in each ageing bucket:

| Ageing Bucket | Balance (AED ‘000) | Adjusted Loss Rate | ECL (AED ‘000) |

|---|---|---|---|

| Current | 10,000 | 0.6% | 60 |

| 1-30 days | 3,000 | 1.2% | 36 |

| 31-60 days | 1,500 | 3.0% | 45 |

| 61-90 days | 800 | 12.0% | 96 |

| Over 90 days | 500 | 60.0% | 300 |

| Total | 15,800 | 537 |

The provision matrix shows both the loss rates and the resulting ECL on trade receivables – AED 537,000 against gross receivables of AED 15.8 million (3.4%).

Common Pitfalls

| Pitfall | Why It’s Wrong |

|---|---|

| Flat loss rate across all buckets | Ignores that older receivables are riskier – rates should increase with age |

| No forward-looking adjustment | IFRS 9 explicitly requires it – historical rates alone are non-compliant |

| No documented default definition | Without a clear definition, loss rate calculations are inconsistent |

| Zero ECL on government receivables | Even low-risk receivables require a non-zero provision under IFRS 9 |

Frequently Asked Questions

What if we’ve never had a bad debt write-off?

Zero historical write-offs does not mean zero ECL on trade receivables. Consider external data (industry loss rates, credit bureau statistics) and near-misses where customers paid very late. A non-zero provision is almost always required.

How often should we update the provision matrix?

At each reporting date. Recalculate loss rates at least annually, and reassess forward-looking adjustments at each period end.

Does this apply to intercompany receivables?

Yes, but intercompany loan receivables must use the general approach (three-stage model), not the simplified approach described here. You must assess whether credit risk has significantly increased since initial recognition.

What about contract assets under IFRS 15?

Contract assets (unbilled revenue) follow the same simplified approach as trade receivables. Include them in your provision matrix, but group them separately if their risk characteristics differ from billed receivables.

Can we use a single loss rate for all customers?

Only if all your customers genuinely share the same credit risk characteristics. In practice, most companies need at least two segments – for example, government vs. private sector, or domestic vs. export customers. Auditors will challenge a single-rate approach if your customer base is diverse.

How do we handle receivables already individually impaired?

Receivables where you’ve identified specific evidence of impairment (customer insolvency, legal disputes) should be assessed individually and excluded from the provision matrix. The matrix applies to the remaining portfolio where you’re estimating collective losses.

Download our bite-size guide on calculating ECL on trade receivables under IFRS 9:

Need Help with Your ECL Calculations?

We help GCC finance teams with IFRS valuation services including IFRS 9 compliant provision matrices and audit-ready documentation.