Understanding the IAS 19 straight-line approach is critical for proper actuarial valuation of End of Service Benefit (EOSB) in Saudi Arabia and proper compliance with IAS 19. When benefit plans are “back-loaded,” IAS 19 paragraphs 70-73 mandate the straight-line approach attribution method.

Key Takeaways: IAS 19 Straight-Line Approach for Saudi EOSB Plans

- IAS 19 Requirement: IAS 19 straight-line approach mandatory under paragraphs 70-73 for back-loaded benefit plans

- Saudi EOSB Structure: Accrual rate doubles from 0.5 to 1.0 months/year at 6-year mark, creating back-loaded pattern

- Financial Impact: Higher early-year liabilities but smooth, predictable service costs

- Compliance: Essential for accurate IAS 19 financial statement disclosures and actuarial valuation EOSB

Table of Contents

1. Back-loaded Accrual Pattern of Saudi EOSB Plan

Saudi Labor Law creates a benefit accrual pattern that increases as the amount of service increases. The statutory Saudi EOSB plan grants an employee 1/2 month salary for each year of service for the first 5 years, and 1 month salary for each year of service after first 5 years. Such a pattern of accrual is classified as a “back-loaded” pattern and this triggers a requirement in IAS 19 to recognise some part of higher accruals in later years early on during service.

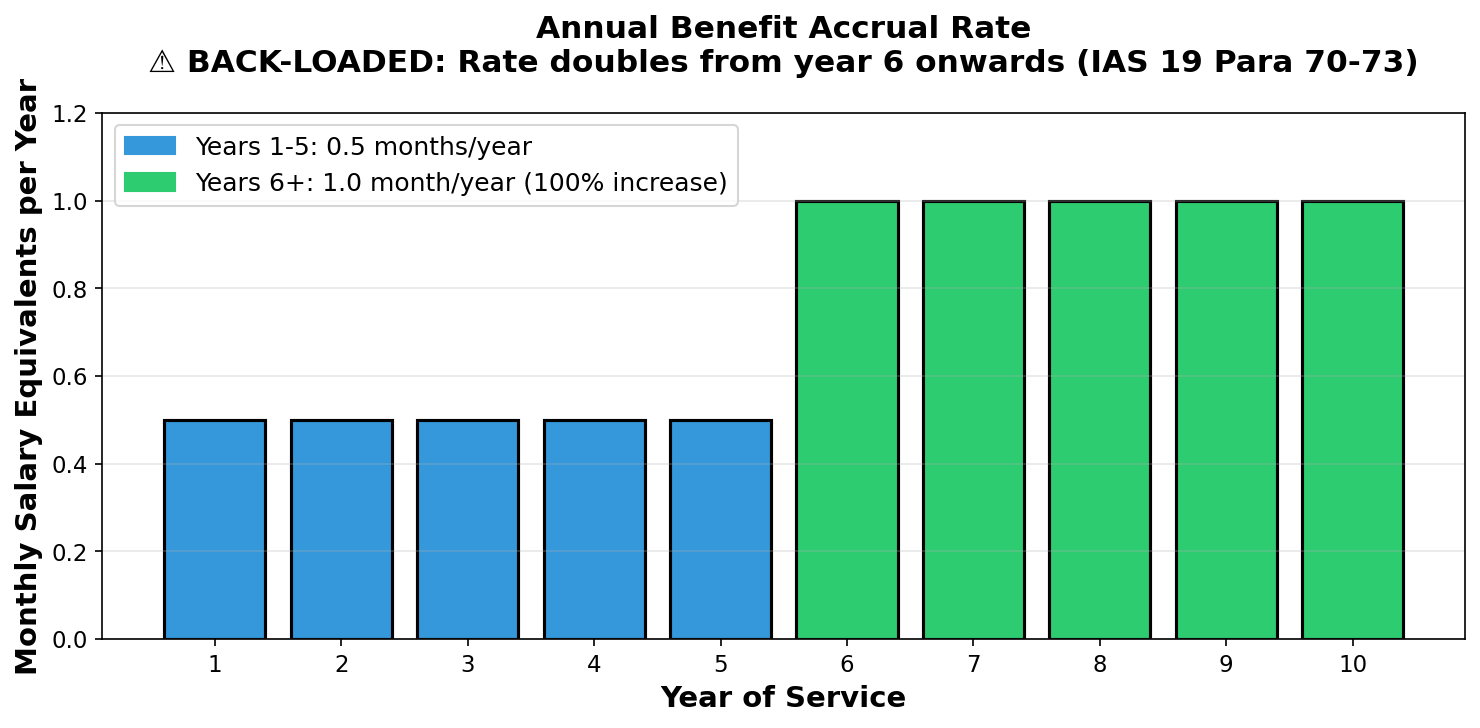

Consider an employee due to retire in 10 years after joining a Saudi company. The chart below shows the rate at which benefit accrues under a typical Saudi EOSB plan:

Years 1-5 (blue bars) accrue at 0.5 months of salary per year, while years 6 onwards (green bars) accrue at 1.0 months per year. This 100% increase in the accrual rate is the defining characteristic of a back-loaded benefit structure that necessitates even attribution for proper actuarial valuation for EOSB under IAS 19.

What Makes a Benefit Plan “Back-Loaded”?

A benefit plan is considered “back-loaded” when employees earn a materially higher proportion of their total benefit in later years of service. For Saudi EOSB:

- In the first 5 years, an employee earns 2.5 months (33% of 10-year total)

- In the next 5 years, an employee earns 5.0 months (67% of 10-year total)

- This means twice as much benefit accrues in the second half of a 10-year tenure

- This pattern clearly violates the principle of even attribution across service periods, triggering this IAS 19 requirement

2. Why IAS 19 Requires Using the Straight-Line Approach for Saudi EOSB

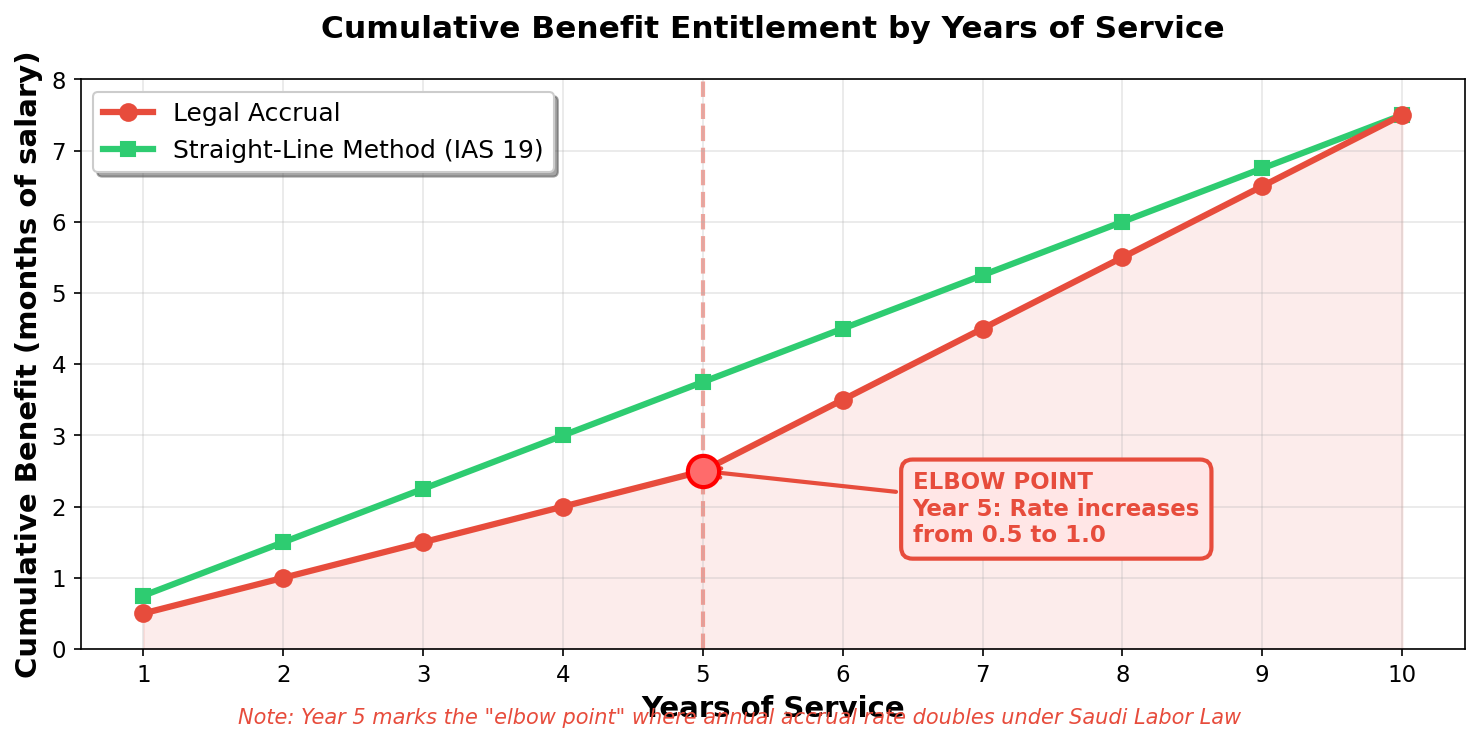

The annual accrual pattern described above is also visible in the cumulative benefit accrual for EOSB:

This cumulative benefit chart demonstrates how total EOSB entitlement grows over time under Saudi Labor Law. The red line in the chart represents how the benefit will accrue if just the legal accrual approach (also known as service increment approach) was followed. Notice the clear “kink” or “elbow point” at year 5, where the slope of the line increases significantly due to the doubling of the accrual rate. This doubling of accrual rate at the elbow point is precisely why the straight-line approach is essential for actuarial valuation of EOSB.

Critical IAS 19 Requirement for Actuarial Valuation of EOSB

Because the benefit formula provides materially higher benefits for later years of service (100% increase at year 6), the IAS 19 straight-line approach is mandatory under IAS 19 paragraphs 70-73. This ensures the IAS 19 disclosures properly reflect the economic substance by recognizing service cost evenly over the service period, rather than following the kinked legal accrual pattern. This is not a choice — it is a compliance requirement under IAS 19 (International Accounting Standard 19).

The green line in the chart demonstrates how the benefit will accrue if this method was used instead. This results in much more uniform benefit accrual.

IAS 19 Perspective on the Straight-Line Approach

- Benefits are attributed evenly to periods of service

- Each year of service earns an equal proportion of the ultimate benefit

- Consistent with the “service cost” concept in actuarial valuation of EOSB

- Avoids front-loading or back-loading of costs in financial statements

- Provides comparable financial reporting across different benefit plan designs

Economic Substance Behind the Straight-Line Approach

- Employees provide service evenly over time, regardless of legal accrual formulas

- This method reflects this economic reality

- Even recognition matches workforce contribution patterns

- Reduces volatility in P&L recognition for actuarial valuation EOSB

- Aligns accounting treatment with the underlying employment relationship

3. Practical Example Demonstrating Straight-Line Approach

Note: This example demonstrates only the principle of benefit accrual. The actuarial implementation of the straight-line approach is covered in this post.

Context: Consider an employee who has just joined a company and is due to retire in 10 years. For simplicity, we assume that the employee is certain to stay in the company till retirement.

Method 1: Legal Accrual

Under this approach, the liability equals what has legally accrued based on the Saudi Labor Law formula:

| Years of Service | Calculation | Accrued Benefit (months) |

|---|---|---|

| Year 3 | 3 × 0.5 | 1.5 months |

| Year 5 | 5 × 0.5 | 2.5 months |

| Year 6 | (5 × 0.5) + (1 × 1.0) | 3.5 months |

| Year 7 | (5 × 0.5) + (2 × 1.0) | 4.5 months |

| Year 10 | (5 × 0.5) + (5 × 1.0) | 7.5 months |

⚠️ Non-Compliant Method: This approach follows the exact legal accrual pattern but does NOT comply with IAS 19 requirements. It creates a step-change in service cost at year 6, which violates IAS 19 paragraphs 70-73.

Method 2: IAS 19 Straight-Line Approach

Under the IAS 19 straight-line approach, the ultimate benefit (7.5 months at 10 years) is attributed evenly across all service years:

Step 1: Calculate Annual Service Cost (Straight-Line Method)

7.5 months ÷ 10 years = 0.75 months per year

| Years of Service | Calculation | Attributed Benefit (months) |

|---|---|---|

| Year 3 | 3 × 0.75 | 2.25 months |

| Year 5 | 5 × 0.75 | 3.75 months |

| Year 6 | 6 × 0.75 | 4.50 months |

| Year 7 | 7 × 0.75 | 5.25 months |

| Year 10 | 10 × 0.75 | 7.5 months |

✓ IAS 19 Compliant: The IAS 19 straight-line approach produces smooth, predictable service cost patterns and converges to the same final liability while ensuring compliance with IAS 19 paragraphs 70-73.

Comparison: Legal Accrual vs Straight-Line Method

| Years of Service | Legal Accrual (months) | Straight-Line Method (months) | Difference |

|---|---|---|---|

| Year 3 | 1.5 | 2.25 | +0.75 |

| Year 5 | 2.5 | 3.75 | +1.25 |

| Year 7 | 4.5 | 5.25 | +0.75 |

| Year 10 | 7.5 | 7.5 | 0 |

Key Difference in Using Even Attribution

This method recognizes higher liability in early years (e.g., 3.75 vs 2.5 months at year 5) but produces stable annual service costs. Both methods reach the same total liability of 7.5 months at year 10, but only this attribution method complies with IAS 19 requirements for back-loaded schemes. The difference represents approximately 50% higher liability in early years under the compliant methodology.

4. Action Items for IAS 19 Compliance

Implementing this method requires coordination between finance, HR, and actuarial teams:

| Action Item | Priority | Timeline | Responsible Team |

|---|---|---|---|

| Review current EOSB valuation methodology for IAS 19 compliance | High | Immediate | Finance/CFO |

| Identify whether current actuarial valuation EOSB uses legal accrual or straight-line attribution | High | Immediate | Finance |

| Engage with actuarial consultant to implement this methodology if needed | High | Before year-end | Finance |

| Prepare employee census data for actuarial valuation EOSB | Medium | Q4 | HR/Payroll |

| Discuss accounting treatment and disclosure requirements with auditors | Medium | Before audit | Finance |

| Update financial models to reflect this methodology | Medium | Before reporting | Finance |

| Review and update IAS 19 disclosure notes in financial statements | Low | Annual | Finance |

For more information on implementing this method, explore our resources on actuarial consulting services.

5. Frequently Asked Questions Related to Straight-Line Approach

What is the IAS 19 straight-line approach?

The IAS 19 straight-line approach is an attribution methodology required by IAS 19 for actuarial valuation EOSB and other employee benefit plans where benefits accrue at materially different rates across service periods. This method attributes the total ultimate benefit evenly across all years of service, ensuring smooth and consistent service cost recognition.

When is the IAS 19 straight-line approach required for actuarial valuation EOSB?

This attribution method is required when the benefit plan is “back-loaded” under IAS 19 paragraphs 70-73. This occurs when the benefit formula provides materially higher benefits for later years of service. The Saudi EOSB scheme qualifies because the accrual rate doubles from 0.5 to 1.0 months per year at the six-year mark, making this approach mandatory for proper actuarial valuation EOSB.

How does the IAS 19 straight-line approach differ from legal accrual in actuarial valuation EOSB?

The legal accrual method follows the exact benefit entitlement under law (0.5 months for years 1-5, 1.0 months for years 6+), while the straight-line method spreads the total benefit evenly (0.75 months per year for a 10-year service period). For actuarial valuation of EOSB, both methods reach the same final liability, but only this method complies with IAS 19 requirements for back-loaded plans.

Does IAS 19 require using Projected Unit Credit method for valuation?

The straight-line method sets out just the accrual of benefit, while Projected Unit Credit (PUC) method is the method of actuarial valuation. PUC sets out the framework for valuing the accrued benefit. The use of this approach does not contradict with the requirement to use the PUC method.

Related Resources Actuarial Valuation, EOSB, IAS 19

- Actuarial Consulting Services for IAS 19 Compliance

- Employee Benefits Valuation Using IAS 19 Straight-Line Approach

- Expert Insights on Actuarial Valuation EOSB and IAS 19

- General Description of the Straight-Line Approach

- IAS 19 Employee Benefits – IFRS Foundation

- Saudi Labor Law (Royal Decree No. M/51)

Questions About IAS 19 Implementation?

Implementing the straight-line approach for EOSB valuations involves technical judgment on classification, assumption-setting, and disclosure requirements. If you’re navigating these compliance questions, our team has experience supporting organizations across the GCC with IAS 19 valuations.