When reviewing an actuarial valuation, one of the most closely examined figures is the movement in actuarial gains and losses. These movements, known as remeasurements under IAS 19, can vary significantly from one year to the next and may have a noticeable impact on a company’s financial position. For organisations with long-term employee benefit schemes, understanding why actuarial gains and actuarial losses emerge is essential for interpreting valuation results and managing future risk.

This article explains why actuarial losses arise, how actuarial gains occur, what large swings mean for a business, and how companies can better manage the volatility revealed in an actuarial valuation.

What are actuarial gains and actuarial losses?

During each actuarial valuation, the actuary compares:

-

what was expected to happen if the actual experience during the reporting period was exactly as per the opening assumptions; with

-

what actually happened during the period (e.g. how much salary increments were given and how many employees left service), and what is now expected to happen using updated closing assumptions.

If the new valuation shows that liabilities are lower than anticipated as per the opening assumptions, this results in actuarial gains. If liabilities are higher, an actuarial loss arises.

Under IAS 19 and Ind AS 19, these movements are recognised in Other Comprehensive Income (OCI) rather than the profit and loss account. Although they do not immediately affect reported profit, they do influence the balance sheet, equity, funding strategy, and long-term management decisions.

Why actuarial gains and losses arise

Actuarial gains or losses occur when the cost of providing benefits turns out to be different from what opening assumptions suggested. They generally come from two areas.

Experience differing from assumptions

These differences arise when actual events do not match the assumptions used in the previous actuarial valuation. Typical examples include:

-

Salary increases higher than expected

-

More retirements, resignations, deaths or ill-health events than projected

-

Higher-than-expected benefit payments

-

Investment returns that fall short of assumed long-term rates (for funded schemes)

-

Membership profile changes not previously anticipated

Depending on whether these events increase or decrease the liability, they can create either actuarial gains or actuarial losses.

Changes to actuarial assumptions

Actuaries regularly update assumptions to reflect current market conditions and the best available evidence. These updates often cause volatility in actuarial gains and losses. Major contributors include:

-

Lower discount rates due to falling corporate bond yields

-

Higher inflation expectations, affecting salary or benefit projections

-

Updated mortality tables, reflecting longer life expectancy

-

Changes in retirement patterns, withdrawal rates or demographic trends

A downward movement in discount rates, in particular, is one of the most common causes of large actuarial losses.

Other reasons

There are other reasons why actuarial gains might arise. One of the most common ones is due to modelling limitations which might mean that the actual benefits paid to employees is not the same as what the model had calculated. If actual benefit paid is lower than what model had calculated, then an actuarial gain would arise.

Actuarial gains and losses also arise because of corporate transactions such as mergers and acquisitions.

What large swings in actuarial gains and losses mean

Significant year-on-year movements in actuarial gains and actuarial losses can signal:

-

High sensitivity of liabilities to discount rates or inflation assumptions

-

Volatile or unexpected workforce behaviour

-

Potential issues with data accuracy or incomplete member records

-

Underperformance in a scheme’s investment strategy

-

Changes in demographics or long-term expectations that the business should understand

Large actuarial losses are not always evidence of poor performance. They often reflect external economic conditions. However, they provide valuable insight into the risks and sensitivities affecting a benefit plan.

How companies can get to grips with actuarial losses

Organisations can take several steps to understand and manage volatility in actuarial gains and losses.

Strengthen data quality

Good HR and payroll data reduces unexpected experience deviations. Regular reconciliation and mid-year checks can prevent surprises.

Carry out sensitivity and scenario testing

Testing how liabilities respond to small changes in discount rates, inflation or mortality helps teams understand where volatility might arise. This post describes how benefit plans react to changes in certain assumptions.

Review funding and investment strategy

For funded schemes, steps such as matching asset duration with liability duration, or considering liability-driven investment (LDI) strategies, may help manage risk.

Reassess assumptions carefully

Assumptions should reflect long-term expectations rather than short-term market fluctuations. Consistency improves comparability across valuations. In particular, it is important to correctly set salary escalation and employee turnover assumptions.

Consider mid-year or quarterly valuations

Interim valuations help monitor emerging trends rather than relying solely on year-end results, leading to quicker and more informed decision-making.

Maintain strong engagement with actuaries and auditors

Regular dialogue ensures assumptions remain appropriate, emerging issues are addressed early, and valuation results are well understood.

Actuarial gains and losses on assets

This section so far has discussed actuarial gains and losses arising on liabilities. But actuarial gains or losses can arise on plan assets as well, if the benefit plan is funded. However these are much easier to understand – any excess return earned during the reporting period over what was expected becomes actuarial gain. Where actual return is less than expected, an actuarial loss arises.

Actuarial gains and losses on asset side are treated in the same way as those on the liability side.

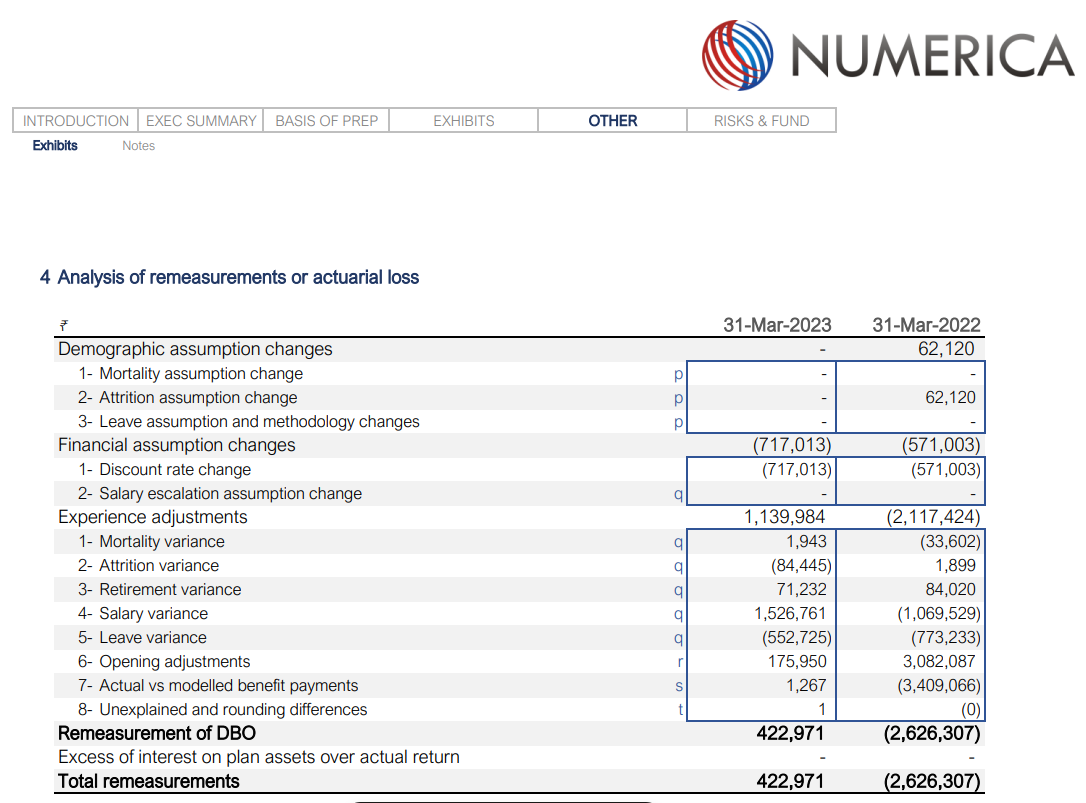

Detailed analysis of actuarial gains and losses

Most accounting standard do not mandate splitting actuarial gains into any significant detail. E.g. in AS 15 reports, actuarial gains are reported as just one number in P&L statement. However, a detailed analysis of actuarial gains and losses arising in the reporting period can provide a number of insights; e.g. how sensitive the benefit plan is to various assumptions and economic conditions. But more importantly, it directly reveal any hidden errors in the actuarial valuation.

Final thoughts

Movements in actuarial gains and losses are an essential part of every actuarial valuation. A large actuarial gain or loss in any given period does not necessarily indicate there’s something inherently wrong with the actuarial calculations. However, if these numbers show up unexpectedly in your report, you would benefit from looking at a detailed analysis such as the one presented above.

Learn the basics of actuarial valuations by downloading the guide below:

ABOUT NUMERICA

Numerica is a leading provider of actuarial and valuation services to clients in India. We provide full range of actuarial services including actuarial valuation of gratuity, leave and pension plans. We have also introduced a range of other non-traditional actuarial services to Indian companies.