What are the factors that will have an impact on the actuarial valuation of gratuity liability? What will be the magnitude of this impact? How will the gratuity liability impacted if the government increases gratuity limit to ₹20 lakhs?

These are questions about the actuarial valuation of gratuity which almost every company’s management team wants to know, but probably get to know only after the year-end valuation. Many companies have expressed a need to know what the year-end position is expected to be so they can take a corrective action, if needed.

To address this issue, we have performed three types of sensitivity analyses and compiled in this post:

- How the major actuarial assumptions affect the gratuity liability

- How changes to certain plan provisions can affect the gratuity liability

- How employees with different characteristics can have very different liability, depending on their age, salary and past service.

We also have separate service offerings to address this issue, which you can check out here.

Quick recap of a statutory gratuity plan:

- Benefit formula = 15/26 * years of past service * final salary

- Benefit events: Death, disability, resignation (attrition) and retirement

- Vesting period (i.e. minimum service period) = 5 years, in case of resignation and retirement only

Sensitivity to actuarial assumptions

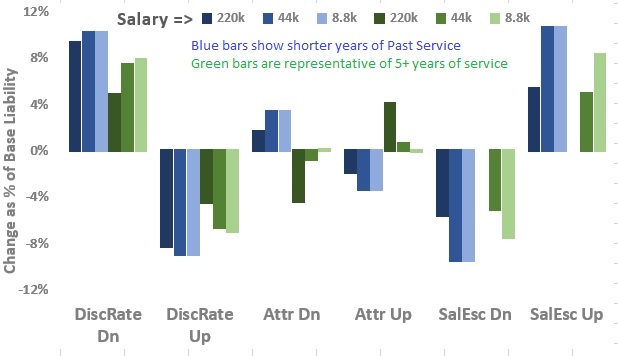

We have created a chart below for various levels of salary and to show how sensitive each salary class is to various assumptions. We will be discussing this chart in detail to explain the impact of actuarial assumptions.

Key observations:

- Liability increases with fall in discount rate (see “Dn DiscRate”) and vice-versa (see “Up DiscRate”)

- The impact of attrition rate is more complex and depends on age, salary and years of past service (see “Dn Attr” and “UpAttr”)

- Liability falls with fall in salary escalation rate (see “Dn SalEsc”) and vice-versa (see “Up SalEsc”)

1. Discount rate:

This is one of the most important assumptions in the actuarial valuation. Setting the right discount rate can be a complex task (read more here) and the process should be given due consideration.

- Generally, an increase in discount rate results in lower gratuity liability and vice-versa. This was also observed in the chart above.

Quick tip: If this does not hold true, then in most of the cases, it may imply an error in valuation.

- Magnitude of the change often depends on a lot of factors, one of the most important being the DMT (or the duration of the liability). The longer the mean duration of liability, the more sensitive will it be to the discount rate.

2. Attrition rate

Attrition rate is decided by the management of the company. Read how to set attrition rate assumption for actuarial valuation here.

- The impact of its change depends on the employee’s profile, such as salary, age and past service. It also depends on the other actuarial assumptions such as salary escalation and discount rate.

- If an employee has completed five years of service, and the salary escalation assumption is higher than the discount rate, then increasing the attrition rate assumption will reduce the liability. The reverse, i.e. decreasing the attrition rate assumption will increase the liability.

- The impact mentioned in the second point will be reversed, if the discount rate is higher than the salary escalation rate assumption.

- However, the situation is not that straightforward if the employee has not completed five years of service. For instance, if an employee resigns before reaching vesting period of 5 years, the company will not have to pay any gratuity. In most of the cases, an increase in attrition rate will reduce the gratuity liability.

- If the employee is very close to completing, or has completed 5 years of service, then a higher attrition rate translates to an immediate payout. This would cause the liability to increase.

3. Salary escalation rate:

- This one is quite intuitive. A higher salary escalation rate results in higher salary which translates to higher payout. Hence, the gratuity liability increases with an increase in salary escalation rate.

- However, for high-paid employees, a higher salary escalation rate may not result in any significant change because they might have already reached the max payout limit.

- This is evident from the above chart, where salary escalation rate has no impact for a high-paid employee.

- Though, this is true only for an employee who has been in service for longer period. This was also seen in the chart under “salary” head – the liability curve flattens out for longer years of past service.

4. Mortality rate

- A general trend is that mortality rates are reducing due to improvement in healthcare, lifestyle and other factors.

- Assuming the discount rate exceeds the salary escalation rate, an improvement in mortality rate would ideally result in a lower gratuity liability since the expected payout due to death will now be further in future.

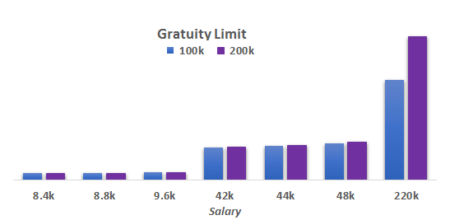

Sensitivity to gratuity limit

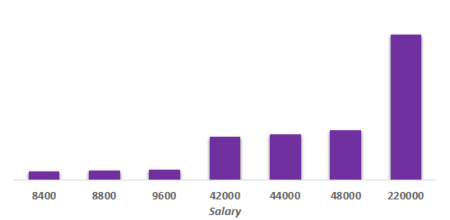

The Government of India will soon increase in gratuity limit to ₹20 lakhs. We had covered the changes in detail here. We will try to explain this further with help of the following chart:

Observation:

- The impact is negligible (less than 4%) for employees with low to medium salary.

- However, for high-income employees, the impact is significant since they were the ones who were most impacted by this limit.

Sensitivity to member’s profile

In this section, we discuss how the gratuity liability varies with the profile of the employees, such as age, salary and past service.

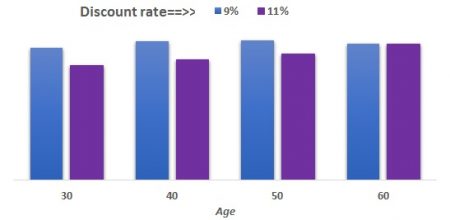

1. Age

- Age of an employee does not have a major impact on gratuity liability. This is also shown in the graph below, where the bars are almost similar for different age groups. (No! it doesn’t meant that you can stop sending the DoB data to your actuaries!)

- However, while we are at it – it is important to explain how age might have an impact on gratuity liability.

- Thinking of it logically, the older the employee is, the closer he/she is to the retirement age, and hence closer to receiving the payout.

- This implies that, assuming the discount rate exceeds the salary escalation rate, the older employee will have a higher liability because of proximity to retirement age.

- If salary escalation rate exceeds the discount rate, the impact will not be that straightforward. It depends on whether or not the employee has reached the benefit limit already.

- Overall, the proximity to retirement age translates to a shorter duration for discounting. You can also see this in the chart below:

Observation:

- Age does not have a major impact on the valuation of gratuity valuation.

- The sensitivity of discount rate change decreases with age, and is almost negligible for employee aged 60.

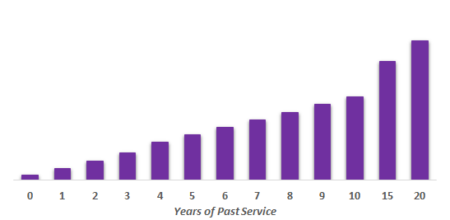

2. Years of past service

- Because of the way the formula is designed, the number of years of past service has a direct impact on gratuity liability.

- Everything else remaining same, the gratuity liability increases almost linearly with the increase in years of past service

Observation:

Gratuity liability increases with increase in years of past service. However, there can be an exception to this, as discussed in the chart below:

Observation:

Accrued benefit for high-income employees may reach the limit (of ₹10 lakhs) after certain years of past service. In such cases, gratuity liability will not be impacted by additional years of past service

3. Salary

- Again a direct impact, higher salary translates to higher gratuity liability.

Observation:

Gratuity liability is much higher for high-income employees. This is because of the way the Gratuity formula works.

Key takeaways:

- An increase in discount rate reduces the actuarial liability of gratuity

- A decrease in discount rate increases the actuarial liability of gratuity

- A decrease in salary escalation assumption reduces the liability, but to a lower extent than increasing the discount rate

- An increase in salary escalation assumption increases the liability, but to a lower extent than decrease in discount rate

- The impact of attrition rate varies on a number of factors

- Increase in gratuity limit will increase the gratuity liability, but only by a small amount (for most companies)

- Employees with a higher salary or more past service will have a higher liability

- Older employees may have higher or lower liability than their younger counterparts, depending on how other assumptions are set

Refer to our primary topic page for more information on other topics related to actuarial valuation of employee benefits.

Disclaimer: The above observations hold true in most of the cases, generally. However, since there are lot of interactive factors which are in play, there might be exceptions to the above simplified observations.

Learn about basics of actuarial valuation of gratuity liability:

February 11, 2024 at 11:45 am, S Tamilselvan said:

Kindly give me the exact formula for arriving at the Present value of past service benefit of Gratuity and Current service cost which is used in LIC valuation reports

December 10, 2024 at 10:48 am, Sheeja said:

Kindly give me the answer for the above question