For many companies, this is the time to finalise their interim accounts for the second quarter of FY 2017-18. An understanding of the movement in discount rate during this period will help in making an appropriate provision towards employee benefits liabilities.

Source of the discount rate for actuarial valuation

Companies often have to set the discount rate by choosing one source from a myriad of alternative sources, which often conflict with each other. Most of these sources are not relevant for the purposes of actuarial valuation, because they don’t depict the full term-structure of yields (or interest rates) or are not calibrated for the Indian economy.

Numerica uses the yield curves published by the Clearance Corporation Of India (CCIL) derived from the trades in GoI bonds on the National Stock Exchange (NSE). The yield curves produced by NSE/CCIL have been in use for over two decades now and are considered to be the true reflection of the interest rates in the Indian economy.

Numerica regularly collates and publishes the prevailing discount rates on this webpage.

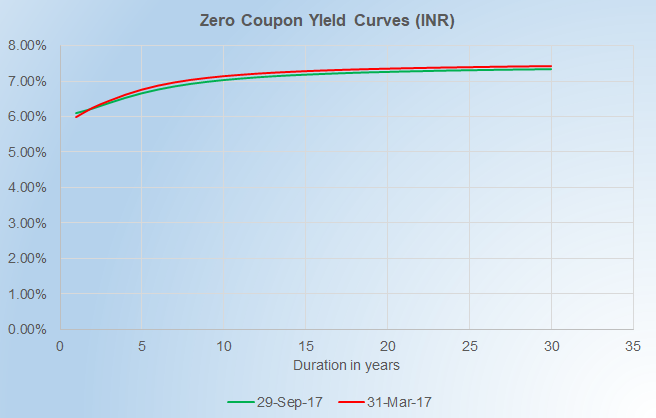

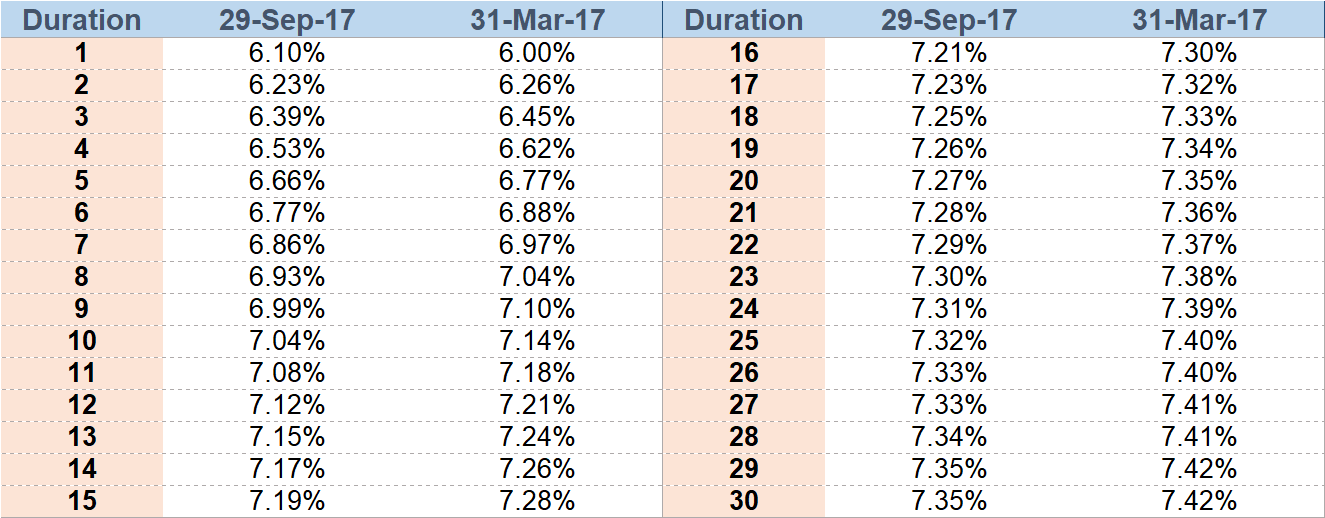

Comparison of yield curves: 30 Sep 2017 vs 31 Mar 2017

The discount rate as at any particular valuation date is read from the yield curve of GoI bonds as at that date. Since 30 Sep 2017 fell on a weekend (non-trading day), the usual practice is to consider the discount rate at the immediately preceding trading day; i.e. 29 Sep 2017. Any reference to discount rate as at 30 Sep 2017 in this post, actually refers to the discount rate as at 29 Sep 2017.

The yield curves as at 31 March 2017 and 30 September 2017 are shown in the chart below. For smaller durations (less than two years), the yields have increased slightly since 31 March. Beyond twoyears, the yields have marginally decreased.

Compared to 30 Jun 3017 (not shown in the above graph and table), the yields have largely increased for longer durations.

What this means for you?

All things equal – as yields go up, the DBO goes down. This effect is diluted by adding in the other parameters that impact the obligation in different ways.

All companies, except those that have exceptionally high attrition rates, would have a liability duration of more than two years and therefore should see a marginal rise in their DBO at the end of the second quarter of this FY, compared to 31 March. However, compared to 30 Jun, the DBO is expected to fall.

For companies which have set aside funds with an insurer, the changes in yield curve could also affect the value of those funds. Usually, a significant portion of these funds is invested in fixed income bonds issued by GoI or corporates, whose values also go down as yield curves rise, which could partially offset the benefit of decrease in DBO.

For more information about how discount rate is set for actuarial valuation, please read this post here.

Download our guide on transitioning to Ind AS from an employee benefits perspective by clicking on the picture below:

November 29, 2017 at 5:52 am, How to set discount rate for actuarial valuation - Numerica said:

[…] to our quarterly discount rate reports to understand the movement of discount rates over each quarter and the impact that could have on […]